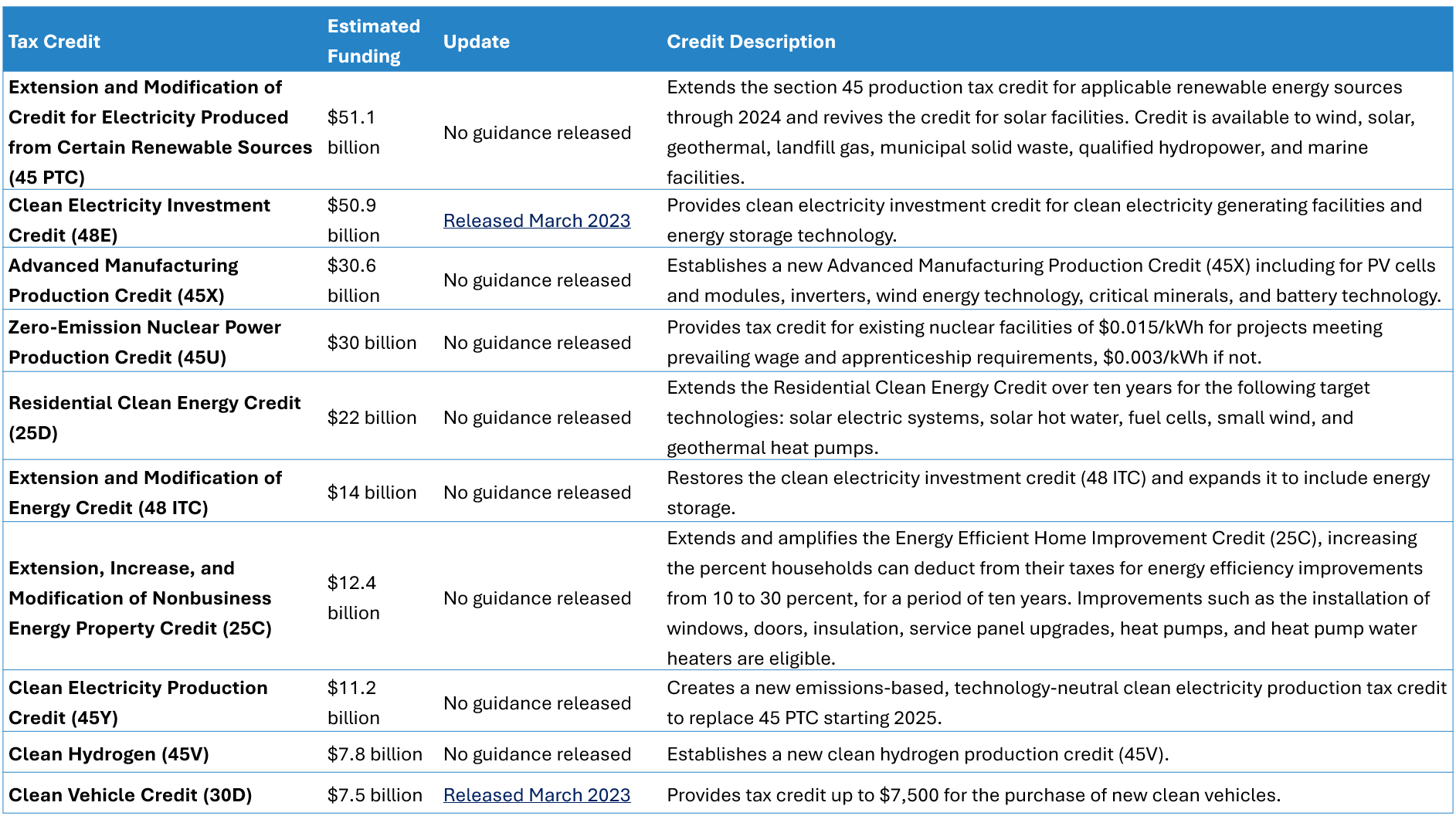

The Inflation Reduction Act (IRA) will deliver an estimated $265 billion in tax credits for the 24 climate tax credits on the Climate Program Portal. These tax credits make up a significant portion of the climate funding from the Acts. Therefore, guidance from the Department of the Treasury on these tax credits will shape the effectiveness of the laws in reducing carbon emissions and delivering other key outcomes.

Some of these tax credits are new and some are extensions and modifications of existing tax credits. It is worth highlighting several important concepts that will shape the uptake and implementation of the tax credits. First, the notion of bonuses. Applicants may be eligible for base tax credits, and then are able to stack bonuses on top of that tax credit if applicable. There are three key bonuses:

- 10 percent bonus for projects that meet labor requirements: applicable for some tax credits, workers must be paid a prevailing wage and apprentices must work on the project. Guidance was released in November 2022.

- 10 percent bonus for projects that meet domestic manufacturing requirements.

- 10 percent bonus for projects located within an “energy community”. In April 2023, Treasury released guidance on the energy community bonus. The guidance clarifies that energy communities include:

- coal communities (where a coal mine closed since 1999 or a coal plant closed since 2009),

- communities that derive a significant proportion of their revenue from fossil fuels,

- or brownfields.

The law also provides stackable credits for solar and wind projects in low-income communities, under 48C. This tax credit includes “an additional 10 percent credit if located in a low-income community or on Indian land, or an additional 20 percent credit if such project is part of a qualified low-income residential building project or qualified low-income economic benefit project.” Treasury released guidance on 48C in February 2023.

Analysis from ICF released in September 2022, anticipated that the labor requirements would be the easiest to meet and the domestic manufacturing would be the most difficult to meet of the bonuses noted here.

Aside from bonuses, it is also worth highlighting tax credit refundability and transferability. Here’s an explanation of the two concepts:

- Refundability (Direct Pay): Direct pay allows entities or individuals that do not owe federal taxes to receive a direct payment instead of a credit against their taxes owed. Some but not all of the clean energy tax credits are eligible for direct pay. Further, several tax credits are only eligible for direct pay for tax exempt entities, for example public entities, nonprofits, or churches.

- Transferability: a new provision that allows entities to transfer certain tax credits to third parties in exchange for cash. This provision could help project developers with limited federal tax liability monetize their tax credits. Some provisions have special rules around transferability. For example, the clean vehicle tax credits only allow taxpayers to transfer the credit to the dealer that sold them the vehicle.

Much of the guidance for the tax credits is still pending, per the table. In a speech in March 2023, Assistant Secretary for Tax Policy at the Department of the Treasury Lily Batchelder said, “In the coming months, Treasury will issue guidance on the clean vehicle credit, the energy community bonus, the domestic content bonus, direct pay and transferability, and the prevailing wage and apprenticeship standards required to receive full credits.” As of April 19, 2023, Treasury has issued guidance on the clean vehicle credit and the energy community bonus as mentioned.

Another tax credit awaiting guidance is 45V – the Clean Hydrogen tax credit. This new tax credit has received a considerable amount of attention of late as the design of the credit could shape the industry and it’s emissions for years to come. Much of the discussion on the tax credit revolves around the source of the energy used to create hydrogen. Energy Innovation released analysis in April 2023, the Clean Air Taskforce released a joint letter in February 2023, and Princeton University released analysis in December 2022. Professor Leah Stokes from the University of California, Santa Barbara, also wrote an op-ed in the New York Times in April 2023 about getting the standards right to ensure emissions reductions from hydrogen. These groups are broadly stating the same three principles to ensure the hydrogen is indeed clean:

- Hydrogen projects must use new clean power.

- Hydrogen projects must draw on new clean power nearby.

- “Hydrogen needs to be produced at the same time of day that the new clean energy is flowing into the grid, to ensure that it doesn’t end up using electricity from dirtier sources that are available at other times of day.”

Treasury also has a handy page summarizing developments about the tax credits from the Inflation Reduction Act.

We will continue to track new developments on tax credits on the Portal. See any to add? Get in touch: info@climateprogramportal.org

Note there were no tax credits in the Infrastructure Investment and Jobs Act. Funding Amount for tax credits is drawn from estimates from the Congressional Budget Office released in September 2022, however the exact amount will depend on uptake.