Direct pay enables tax-exempt entities to receive payment equal to the full value of the Investment Tax Credit (ITC) and its bonus credits after a clean energy project has been placed in service. This new provision from the Inflation Reduction Act will allow nonprofit organizations, states, local governments, and Tribal Nations, among others to more fully participate in the benefits of clean energy.

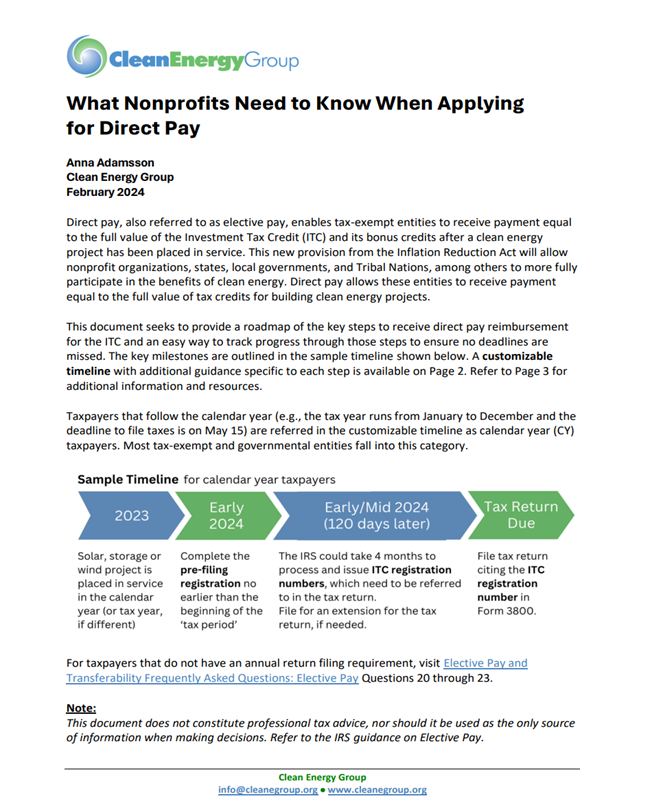

This document seeks to provide a roadmap of the key steps to receive direct pay reimbursement for the ITC and an easy way to track progress through those steps to ensure no deadlines are missed. Projects can refer to the customizable timeline within this guide when planning to apply for direct pay.

More About this Resource

Publisher: Clean Energy Group

Date: February 13, 2024

Type: Fact Sheet

Sector(s): Other Climate

State(s): None