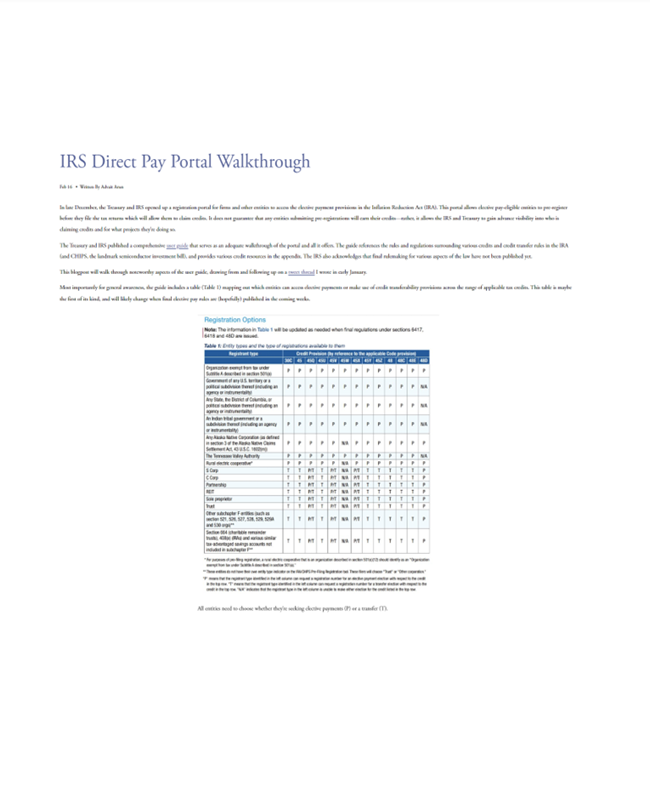

In late December, the Treasury and IRS opened up a registration portal for firms and other entities to access the elective payment provisions in the Inflation Reduction Act (IRA). This portal allows elective pay-eligible entities to pre-register before they file the tax returns which will allow them to claim credits. It does not guarantee that any entities submitting pre-registrations will earn their credits—rather, it allows the IRS and Treasury to gain advance visibility into who is claiming credits and for what projects they’re doing so. The Treasury and IRS published a comprehensive user guide that serves as an adequate walkthrough of the portal and all it offers. The guide references the rules and regulations surrounding various credits and credit transfer rules in the IRA (and CHIPS, the landmark semiconductor investment bill), and provides various credit resources in the appendix. The IRS also acknowledges that final rulemaking for various aspects of the law have not been published yet. This blogpost will walk through noteworthy aspects of the user guide, drawing from and following up on a tweet thread the author wrote in early January. Most importantly for general awareness, the guide includes a table (Table 1) mapping out which entities can access elective payments or make use of credit transferability provisions across the range of applicable tax credits. This table is maybe the first of its kind, and will likely change when final elective pay rules are (hopefully) published in the coming weeks.

More About this Resource

Publisher: Center for Public Enterprise

Date: February 16, 2024

Type: Report

Sector(s): Other Climate

State(s): None