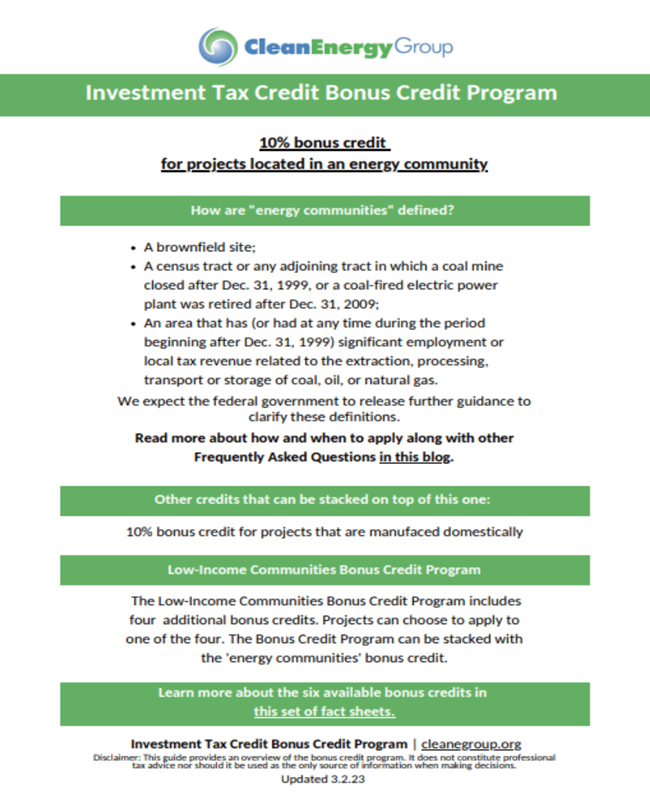

These fact sheets introduce each of the six bonus credits available within the Investment Tax Credit (ITC) for solar, wind, and storage projects. These fact sheets share who is eligible to apply for each credit and which credits can be paired together.

The two stackable credits:

- 10% bonus credit for projects located in an “energy community”

- 10% bonus credit for projects that meet domestic manufacturing requirements

The four credits within the Low-Income Communities Bonus Credit Program:

- 10% bonus for projects located in a low-income community

- 10% bonus for projects located on Tribal Land

- 20% bonus for projects when the facility is part of a qualified low-income residential project

- 20% bonus for projects when the facility is part of a qualified low-income economic benefit project

Each fact sheet will be updated periodically as new information becomes available. Last updated July 2023.

More About this Resource

Publisher: Clean Energy Group

Date: February 27, 2024

Type: Fact Sheet

Tags: Clean Energy, Inflation Reduction Act, Solar, Tax Credits, Wind

Sector(s): Electricity, Other Climate

State(s): None