Introduced in the Inflation Reduction Act, elective pay (also known as “direct pay”) enables tax-exempt entities to receive federal climate and clean energy tax credits as direct cash refunds from the IRS. This year alone, elective pay will likely bring back hundreds of millions of dollars to non-profits, Tribes, states, local governments, and rural electric cooperatives across the country for projects they completed in 2023. As interest in and knowledge of elective pay grows, eligible entities are starting to consider how they can maximize the financial benefits of elective pay by planning for it from the very beginning of their projects.

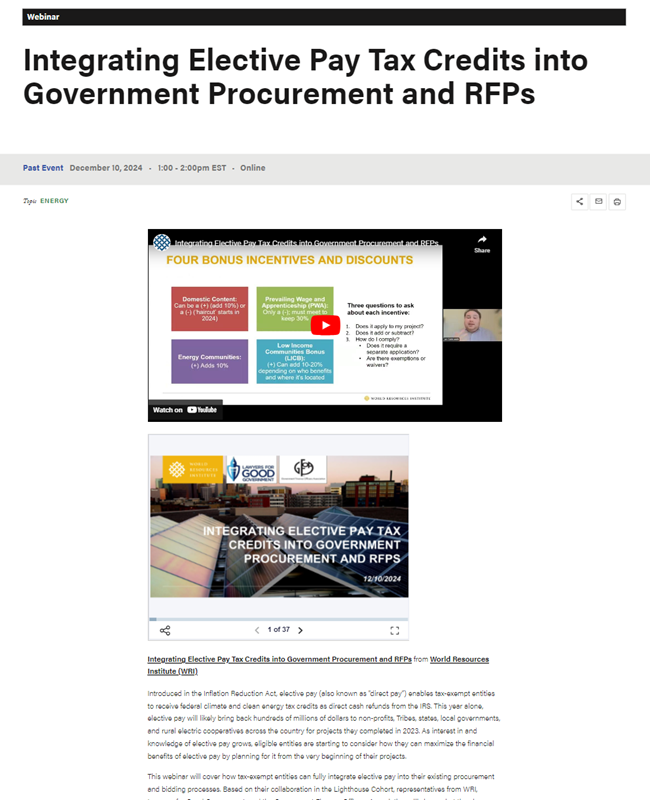

This webinar covered how tax-exempt entities can fully integrate elective pay into their existing procurement and bidding processes. Based on their collaboration in the Lighthouse Cohort, representatives from WRI, Lawyers for Good Government, and the Government Finance Officers Association shared what they have learned about the most important considerations for using elective pay. Their presentation covered the basics of elective pay; key tax credit rules, regulations, and processes that impact purchasing; and strategies for internal coordination around elective pay. Additionally, L4GG discussed RFPs and shared information on upcoming draft sample RFP language.

More About this Resource

Publisher: World Resources Institute

Date: December 16, 2024

Type: Presentation

Sector(s): Other Climate

State(s): None