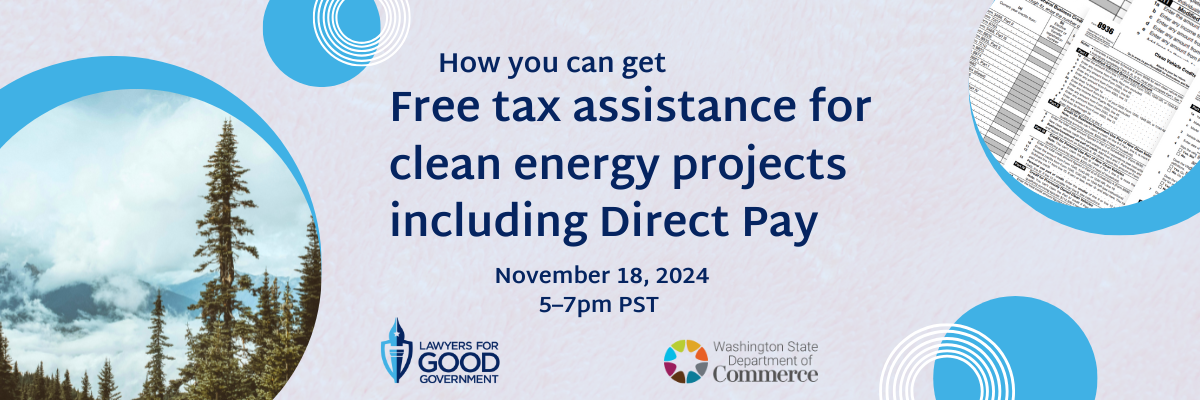

The State of Washington is offering free legal, technical, and filing assistance to entities that may be able to take advantage of the new and expanded tax credits available for clean energy projects like fleet electrification, EV Charging, wind, solar, geothermal projects, etc.

This briefing is designed for tax-exempt entities—including local governments, school districts and universities, non-profits, religious institutions, Tribal entities, ports, and public utilities —whether you are just beginning to explore clean energy projects, already in the planning stages, or have completed a clean energy project that may be eligible now for cash back.

The webinar will highlight the free legal and technical services offered by the State of Washington to help you leverage these powerful credits like grants or loans, tax credits guarantee funds for eligible clean energy projects once the proper forms are filed. The State of Washington has made it much easier to determine eligibility and file those forms by hiring Lawyers for Good Government, Giraffe Financial, and many other partners to guide you through the process- for free!

By attending, you will learn more about how to receive direct pro bono assistance that will help guide you through the process and maximize your project’s potential. Specifically, you will:

- Hear a high-level overview of Direct Pay, including what entities and projects are eligible, and how direct pay works in practice.

- Learn how eligible entities can leverage the Washington CETCAP Program.

- Gain access to a ton of resources, and understand how to combine multiple sources of funding and finance to optimize clean energy initiatives in Washington State.

- Get the opportunity to ask questions directly to Lawyers for Good Government about direct pay, tax credits, and the services being offered.