On Tuesday August 16, 2022, after 18 months of negotiation and speculation, President Biden signed the Inflation Reduction Act (IRA) into law. The IRA includes unprecedented climate funding – quoted at $370 billion – which will go towards clean energy investments and several climate-related grant programs.

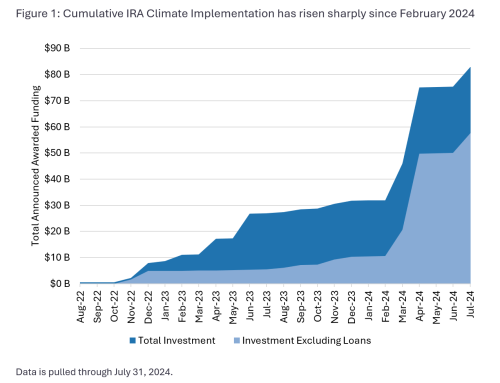

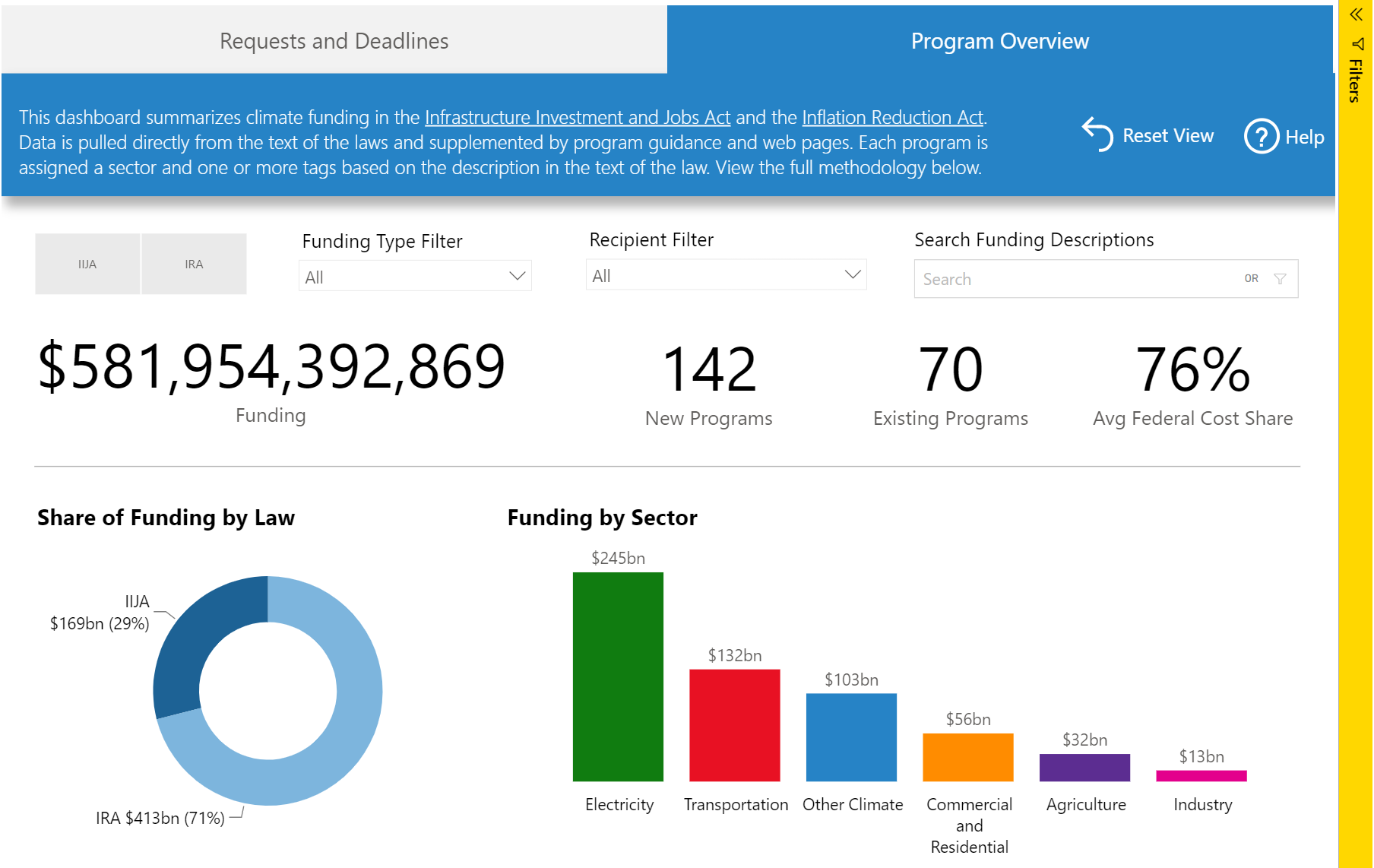

As with the Infrastructure Investment and Jobs Act (IIJA), Atlas will track the funding as well as requests, events, resources, and deadlines associated with the IRA. The first summary of data is now available on the Climate Program Portal Dashboard. You may toggle between the two Laws using the filter in the top left. If you want to see both, then just unselect.

Atlas will continue to fill out that data as more information becomes available. As always, we welcome your suggestions and feedback at info@climateprogramportal.org.

If you need help with finding data on the Portal, you can also sign up for a 15-minute one-on-one session.

Here’s a sample of six new programs on the Portal to give you a taste test of what’s to come.

Section 50145 – Tribal Energy Loan Guarantee Program (DOE)

Provides $75 million for the Department of Energy’s Tribal Energy Loan Guarantee Program, and $20 billion for loan guarantees under the program.

Section 60102 – Grants to Reduce Air pollution at Ports (EPA)

Provides a total of $3 billion to purchase zero-emission port equipment or develop a climate plan.

Equipment refers to human-operated equipment or human-maintained technology that produces zero emissions of any air pollutant that is listed pursuant to section and any greenhouse gas other than water vapor; or captures 100 percent of the emissions that are produced by an ocean-going vessel at berth. Funding is split between general assistance ($2.25 billion) and non-attainment areas ($750 million).

Section 60103 – Greenhouse Gas Reduction Fund (EPA)

This section appropriates $27 billion for grants to deploy low- and zero- emission technologies and support local green bank programs including:

- $7 billion for state, local, and tribal governments or nonprofits to deploy zero emission technologies in low-income and disadvantaged communities

- $20 billion for non-profit green banks or accelerators leveraging private investment to provide direct or indirect financial assistance for projects that reduce greenhouse gas emissions, with at least $8 billion going to low-income and disadvantaged communities.

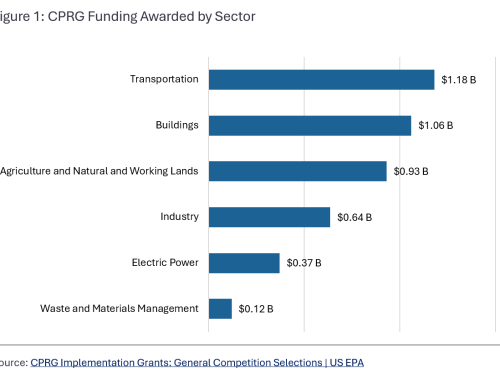

Section 60114 – Climate Pollution Reduction Grants (EPA)

Provides $250 million for grants States to develop a greenhouse gas reduction plan and $4.75 billion for grants to States, tribes, air pollution control agencies, and municipalities to implement the plans.

Section 60201 – Environmental and Climate Justice Block Grants (EPA)

Appropriates $3 billion in grants and technical assistance to implement community-led projects in disadvantaged communities to monitor, prevent, and remediate environmental risks to public health related to air pollution and climate change.

Section 60501 – Neighborhood Access and Equity Grant Program (DoT)

Allocates funding to three pots:

- $1.893 billion to improve transportation access and ameliorate negative social, economic, health, climatic, and environmental impacts related to transportation infrastructure

- $1.262 billion for projects of the same type specifically in disadvantaged communities.

- $50 million is made available to support technical assistance opportunities and sub-grants.

These are just six of 212 programs now tracked on the Climate Program Portal. This takes the total of funding tracked to $581 billion in funding that may go to climate programs across the two Acts.

Tax Credits Galore

Based on estimates from the Congressional Budget Office, IRA includes $266 billion worth of tax credits, more than half of the climate funding in the Law.

The Law creates or extends 24 tax credits spanning clean electricity generation, electric vehicles, hydrogen production, and carbon capture and sequestration. Many of the tax credits are also transferable and eligible for direct pay, enabling entities without adequate federal tax liability to still take advantage of the incentives.

Additionally, several clean energy tax credits offer bonus credits of 10 percent for projects that use materials produced in the U.S. and an additional 10 percent for projects located in energy communities (for a total possible bonus of 20 percent).

Use the new Funding Type Filter to explore the full suite of tax credits in IRA.

The Library is Open!

To help you make sense of it all, here are ten key resources that we’ve seen. We are adding these to our Library. Get in touch with any others you’ve seen and we will continue to update the Library.

- Senate | Inflation Reduction Act One Page

- The White House | STATE FACT SHEETS: How the Inflation Reduction Act Lowers Energy Costs, Creates Jobs, and Tackles Climate Change Across America

- Center for American Progress | How States and Cities Can Benefit From Climate Investments in the Inflation Reduction Act

- BlueGreen Alliance | FACT SHEET: Clean Energy Tax Credits in the Inflation Reduction Act

- BlueGreen Alliance | FACT SHEET: Clean Vehicle Provisions in the Inflation Reduction Act

- BlueGreen Alliance | FACT SHEET: Clean Manufacturing Investments in the Inflation Reduction Act

- BlueGreen Alliance | 9 Million Jobs from Climate Action: The Inflation Reduction Act

- Department of Energy | Inflation Reduction Act Factsheet

- Climate Law Blog | Cities & the Inflation Reduction Act

- Energy Innovation | Updated Inflation Reduction Act Modeling Using The Energy Policy Simulator