By: Tom Taylor and Jaclyn Lea

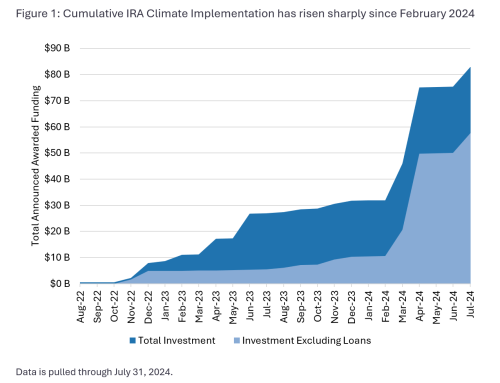

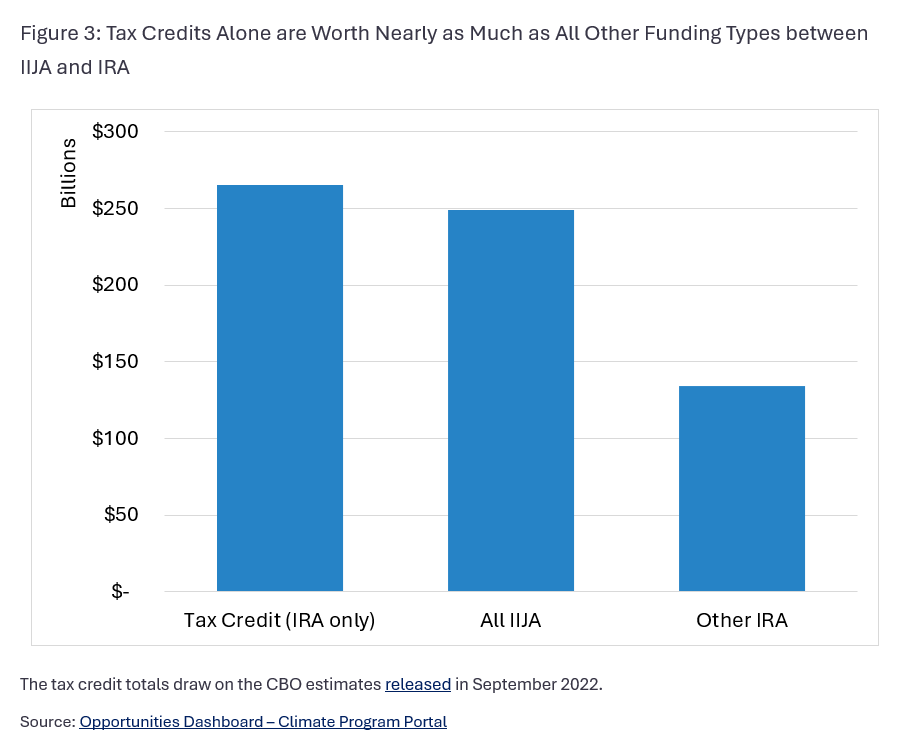

The Inflation Reduction Act (IRA) is delivering the most significant climate investments ever seen in the United States. Through September 5, 2024, per the Outcomes Dashboard of the Climate Program Portal, the Biden Administration has awarded $61 billion from the IRA for climate programs (excluding loans, direct government spending, and tax credits). It is likely that the tax credit totals, as data becomes available, will eclipse all other funding types from the legislation.

There is much to be done to implement the remaining funding, however implementation could be impacted by the upcoming elections in November. In this data story, we dig into the funding yet to be awarded and the key decisions still to be made for the Inflation Reduction Act climate funding.

Tens of Billions Yet to be Awarded

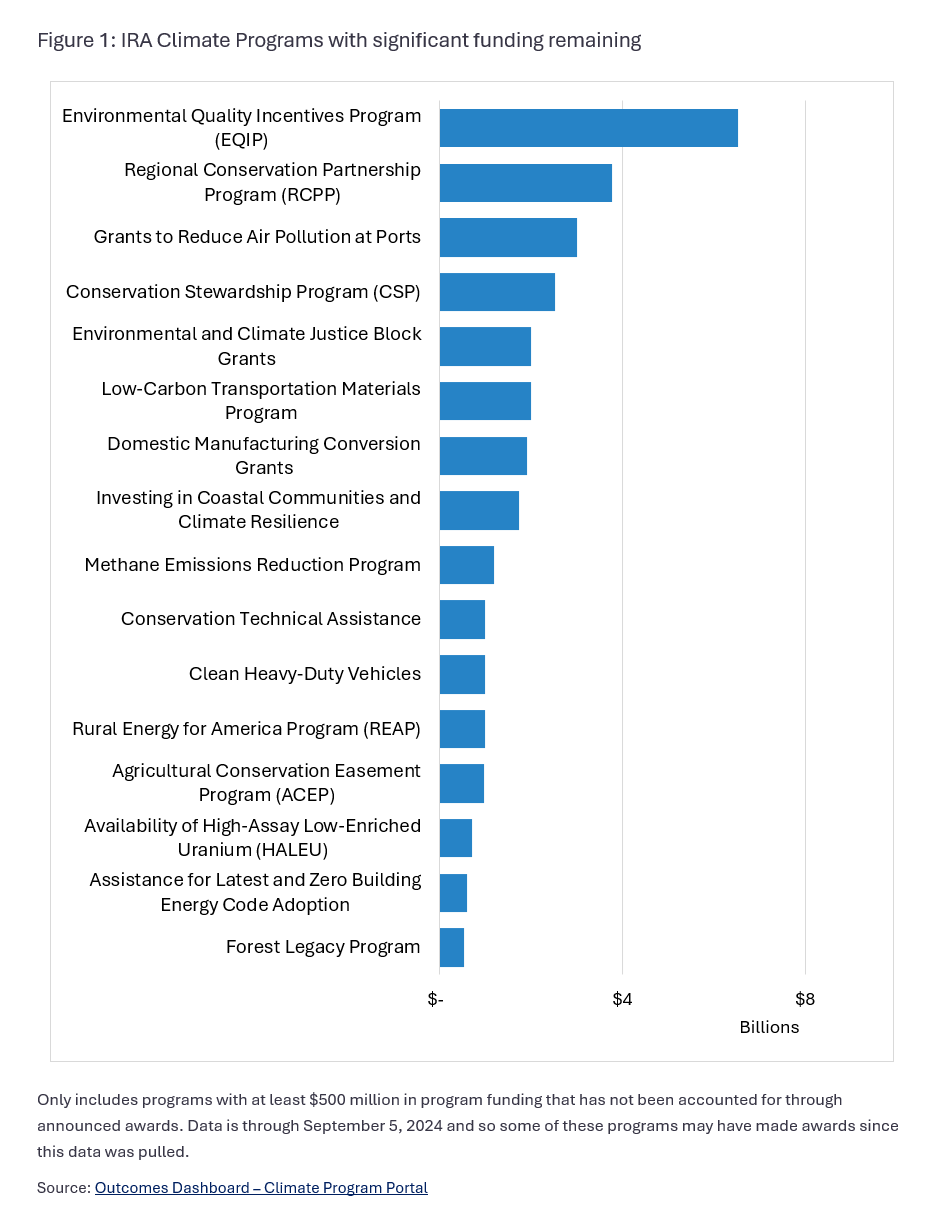

From the Inflation Reduction Act, $61 billion in climate funding has been awarded for more than 6,100 projects (excluding loans, direct government spending, and tax credits) through September 5, 2024. We estimate that the IRA has just over $33 billion (or 35 percent) in remaining funding, again not including federal spending, loans and tax credits. We excluded those totals from this estimate as the data is either inconsistently available, is difficult to compare with grant funding, or in the case of tax credits, there is no cap on uptake. Per Figure 1, this includes 16 programs with more than $500 million in funding not yet awarded to a recipient. The total is an estimate given challenges in accounting for all funding, see Methodology below for further details. Not included in the remaining funding is a further $8.8 billion for the HOMES and HEEHRA programs. This funding has been allocated to state recipients but only awarded to seven states to date – New York, Wisconsin, Arizona, Maine, Rhode Island, New Mexico, and California.

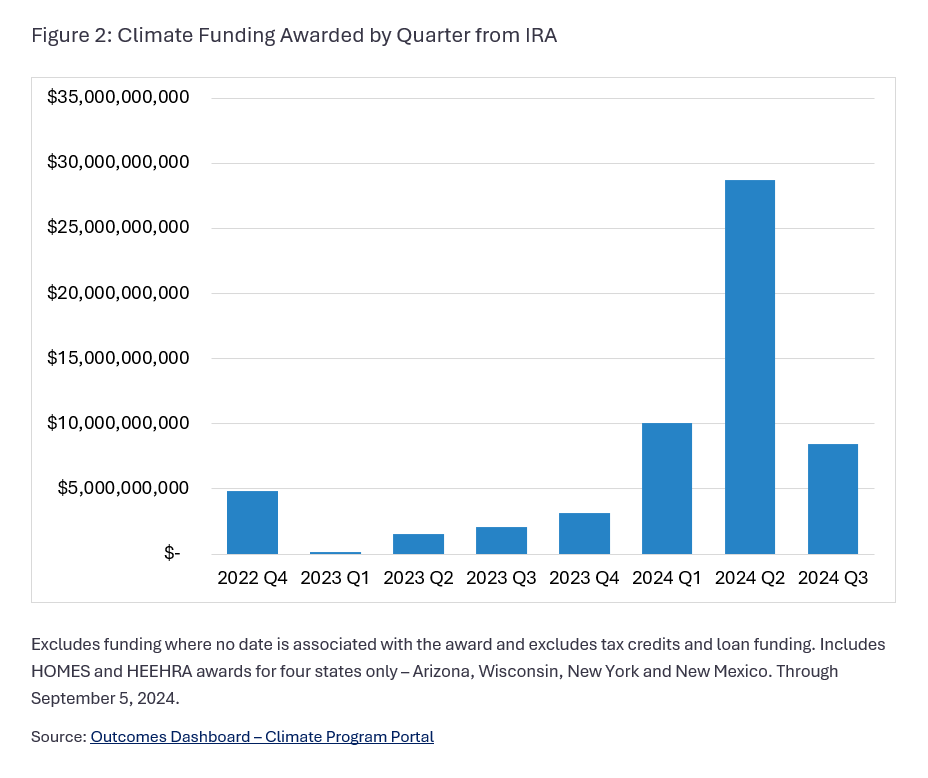

Federal Agencies are Ramping Up Spending

Federal agencies have ramped up award-making in 2024. Including grants and direct federal spending, per Figure 2, over three-quarters of Inflation Reduction Act funding awarded through September 5, 2024, has been awarded in 2024. A large part of this is the result of the Greenhouse Gas Reduction Fund announcement in Q2 2024, however this program only accounts for part of the uptick in spending.

How are the largest funding awards progressing?

There is also a considerable amount of funding that has been awarded – i.e. from a federal agency to a recipient, but that requires action to deliver to final recipients. It is worth taking the time to dig into some of the key programs not on the list above but where there is much to do for implementation, including the Greenhouse Gas Reduction Fund, Home Energy Rebates, and tax credits.

Greenhouse Gas Reduction Fund

The IRA established new pillars of financing climate work through the Greenhouse Gas Reduction Fund (GGRF). The GGRF focuses on providing direct financial assistance to help consumers access clean technologies, supporting community lenders, and increasing access to community solar, especially in low-income and disadvantaged communities. At $27 billion, this is the largest clean energy investment of its kind and one of the most impactful climate programs ever established by the federal government. Through the GGRF, many states will stand up green banks for the first time.

GGRF funds were distributed through three competitions earlier in April this year including:

- The EPA awarded $20 billion under two competitions:

- $14 billion to three applicants under the National Clean Investment Fund

- $6 billion to five applicants under the Clean Communities Investment Accelerator

- The EPA awarded $7 billion to 60 applicants through the Solar for All competition.

All $27 billion has been awarded through the GGRF, but there is still a long way to go in implementing these projects. Since August 16, 2024, GGRF funds have been accessible to all grant recipients, which means they can start implementing their programs and financing clean energy projects. The selected awardees will begin funding projects through existing and new programs beginning Fall 2024. One of the NCIF awardees, Power Forward Communities – a coalition awarded $2 billion to decarbonize homes – planned to launch their program in three communities in early October, and scale in 2025 and beyond. See our conversation with one of the coalition members here. The EPA was required to disperse funds by September 30, 2024. In the meantime, you can continue tracking green banks, community development financial institutions, and GGRF recipients through the Clean Energy Finance tool on the Climate Program Portal.

Home Energy Rebates

The IRA created the $8.8 billion Home Energy Rebate programs, which include the $4.3 billion Home Efficiency Rebates (HOMES) and $4.5 billion Home Electrification and Appliance Rebates (HEEHRA), to support energy-saving retrofits and building electrification. Each state has been allocated funding to set up and administer these rebate programs. Right now, New York, Wisconsin, Arizona, Maine, Rhode Island, New Mexico, and California are the only states where rebates are up and running. Oregon, Washington, Hawaii, Colorado, Minnesota, Indiana, Michigan, Georgia, North Carolina, Washington DC, Vermont, Massachusetts, and New Hampshire are close behind, while the remaining states are still preparing applications or awaiting approval. Earlier this year, South Dakota opted out of participating in the program, rejecting more than $70 million in federal funding.

It is unclear how long it will take to fully implement the HOMES and HEEHRA programs nationwide due to multiple factors influencing the programs’ progress. For starters, some states have long-established programs while others are starting from the ground up. Additionally, each state will go through its own processes of preparing applications, designing the programs, and incorporating public input, which could all slow down the process further. Another critical factor is the outcome of the November elections, which could leave the fate of the HOMES and HEEHRA programs up in the air. Despite these uncertainties, states will likely finish setting up their programs over the coming months. State programs must expend their funds by 2031.

Tax Credits

While tax credits are excluded from our estimate of funding remaining from the IRA, it is critical to understand these implementation opportunities. Clean energy tax credits under the IRA are uncapped and could remain open through 2032, with estimates of their value ranging from $244 billion to over $1 trillion. Per Figure 3, the tax credits carry an enormous share of the climate potential of the legislation and run through 2031.

The Internal Revenue Service (IRS) has been developing guidelines for the range of tax credits created and expanded under the IRA. This includes helping more entities take advantage of this funding by finalizing guidance around elective pay, a new provision that enables tax-exempt entities and governments to receive payments for some clean energy tax credits. Relatedly, transferability, allows entities with limited tax liability to sell their credit to a third-party as a form of project financing (our partner Lawyers for Good Government developed the Clean Energy Tax Navigator to help entities explore elective pay opportunities with eligible tax credits.)

Other provisions of these tax credits are increasing economic opportunity. Many credits offer bonuses to projects that pay prevailing wages and use registered apprentices. The investment and production tax credits further incentivize projects located in federally defined energy communities and low-income communities. While these provisions demonstrate progress, there is still work to be done to ensure that benefits flow to all. Tax credits have historically flowed to higher-income individuals, exacerbating inequities. Moreover, the Justice40 Initiative does not cover tax credits. While we expect to see continued uptake of these incentives, broadening access to these opportunities remains crucial.

Methodology

We track program totals on the Climate Program Portal and crosschecked these program totals with the Invest.gov totals. We took the larger of the totals in the few cases where there were discrepancies. In this way, we ensured that we did not overstate the funding not yet awarded. In a few cases where funding is particularly difficult to track – including the REAP program or Tribal Climate Resilience, we took the Invest.gov total. Given challenges in tracing the origins and status of funding and data availability, these totals constitute estimates. It may be in some cases that the remaining funding has been allocated to other uses not yet identified. The data is pulled through September 5, 2024.