August 16th, 2024 marks the two-year anniversary of the most significant federal climate legislation to date: the Inflation Reduction Act (IRA). One of a kind, the IRA boosted longstanding programs with much-needed funding, established new programs to target key climate concerns, and stood up long-term financing mechanisms for clean energy projects. The Climate Program Portal has been tracking the implementation of IRA’s climate provisions since its passage on its Outcomes Dashboard. In this spotlight, we will review what progress has been made in the two years following the law’s passage, highlight next steps in putting this money to work, and consider what the future of the law looks like.

Federal funding administrators have ramped up implementation efforts

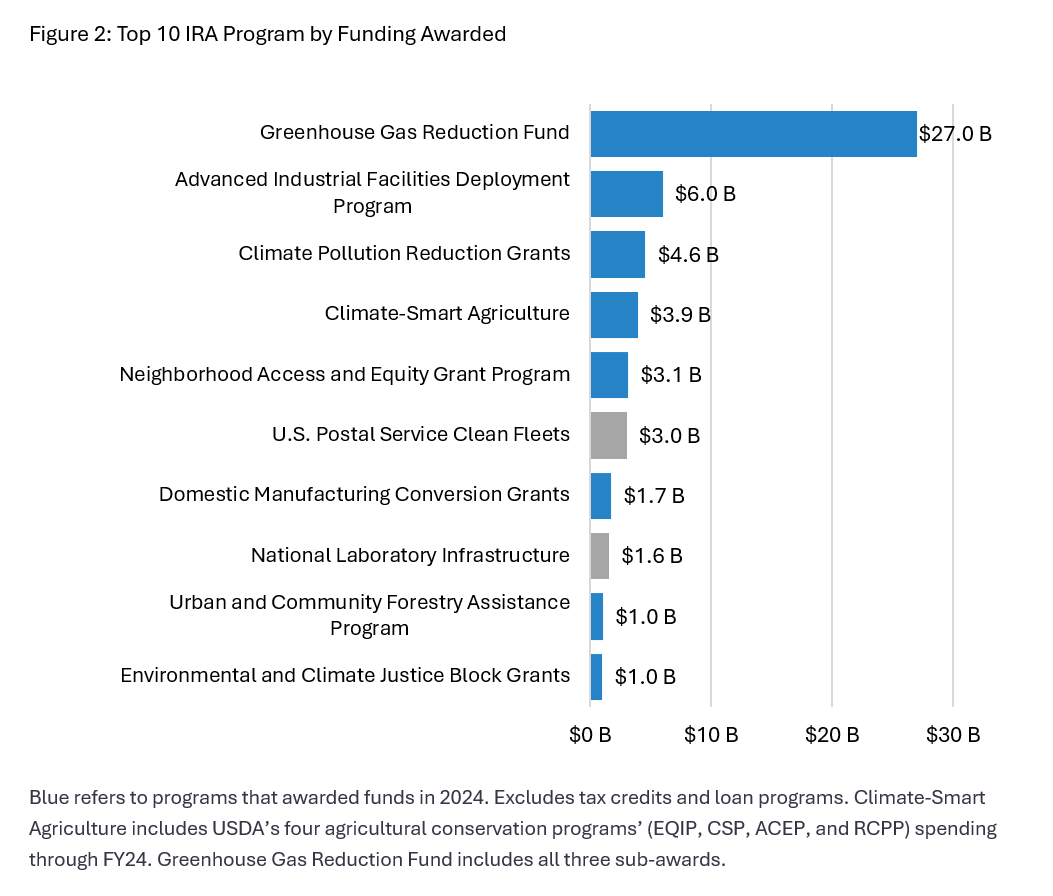

Federal agencies have made significant progress implementing the roughly $110 billion (excluding tax credit estimates and loan authority) in IRA funding for climate work over the last two years. We have seen those efforts especially ramp up in the last six months. To date, agencies have awarded $56 billion of IRA funding – over three-quarters of which were awarded in 2024.

So far, about half of this funding ($56 billion) has been awarded via competitive and formula grant programs. Agencies have been busy in 2024, with some notable announcements including:

- In March of 2024, the Neighborhood Access and Equity (NAE) and Reconnecting Communities (RCP) Grant Programs announced $3.3 billion in awards for transportation planning and construction projects in 132 communities. The funding aims to improve accessibility and prioritize disadvantaged communities.

- Also in March, the Department of Energy (DOE) announced that the roughly $6 billion program for Advanced Industrial Facilities Deployment Program would support 33 projects across more than 20 states.

- In April, the EPA announced the recipients of $27 billion via the three Greenhouse Gas Reduction Fund grants. Announced recipients represent 45 states, and are currently establishing their programs, which are expected to launch this fall. This program alone accounts for almost half of the announced funding to date, and a quarter of all competitive and formula grant funding for climate appropriated by the IRA.

- Another much-anticipated program, the Climate Pollution Reduction Grants Program (CPRG) announced its implementation grants in July. The program will distribute the $4.3 billion to 25 winning applications in the coming months.

- Most recently, the DOE announced that $1.7 billion in Domestic Manufacturing Conversion Grants would support the conversion of 11 shuttered or at-risk auto manufacturing facilities to manufacture electric vehicles in Michigan, Ohio, Pennsylvania, Georgia, Illinois, Indiana, Maryland, and Virginia.

Award announcements span all fifty states

IRA funding has supported projects across all fifty states. California, Texas, and Illinois top the list of states that have received the most grant funding, unsurprising given the states’ population sizes. Alaska, Montana, Vermont, Maine, and Wyoming have seen the most per capita funding to date. 49 states and D.C. will be served by a recipient of EPA’s GGRF Solar for All funding (Iowa is the only state that did not receive funds), money that will offset the costs of installing residential solar for low- and moderate-income households.

Though some have turned down funding

However, states either not applying for or turning down designated funding has led to missed opportunities for some. For example, last year, four states – Florida, Iowa, Kentucky, and South Dakota – declined $3 million each for their CPRG planning efforts. Late last year, Wyoming, who initially took EPA’s planning grant, declined to submit a Priority Climate Action Plan (PCAP) and apply for implementation grant funding, returning their $3 million.

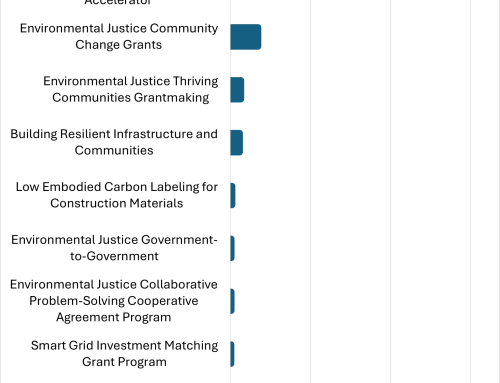

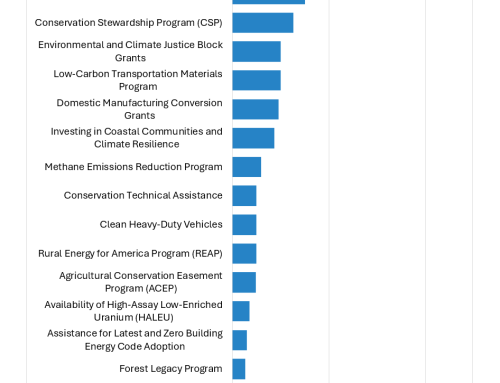

We estimate at least $30 billion of grant funding yet to be awarded

Though much progress has been made in implementing IRA’s funds, many of the programs supported by the law have spending authorities spanning into Fiscal Year 2026 and beyond. In total, we estimate at least $30 billion in grant funding remains to be awarded (does not include loans, direct federal spending or tax credits, as this data is either not available or different in nature). Much of this funding has been made available by program administrators. The Portal currently tracks about $7 billion in currently open RFPs and $10 billion in recently closed yet to be awarded RFPs including:

- $2 billion in Community Change Grants via the Environmental and Climate Justice Block Grant Program, which closes in November, $325 million of which have been awarded as of July 25th.

- Just under $1 billion for the Clean Heavy-Duty Vehicles, whose RFP closed last month.

- $1 billion in Rural Energy for America Program (REAP) grants, which closes in September 2024, about 88 percent of which has already been awarded.

- $850 million for DOE’s Methane Emissions Reduction Program, for which applications are due the end of August.

We expect awardees for these grant cycles to be announced in the months after their application deadlines pass. As for funding not yet made available, which we estimate to be about $14 billion, we are still awaiting implementation updates.

The most significant “pot” of funding in this category is the Climate-Smart Agriculture funding. IRA appropriated about $18 billion for USDA’s four key agricultural conservation programs, alongside an additional $1.5 billion for technical assistance. Thus far, about $3.86 billion of these funds – or about a fifth – have been spent. USDA budget summaries project a boost in spending in Fiscal Year 2025 (which begins in October 2024). At the same time, Congressional disputes over the Farm Bill renewal, in which IRA’s climate-smart agriculture investments are at the center, could impact how these funds are used in the future.

But, rebates, tax credits, loans, and green banks could support clean energy projects for the next decade

Award announcements mark the beginning of implementation for many federal funds. For some IRA initiatives, funding is designed to support climate projects far beyond the initial announcement. Key here are IRA’s suite of clean energy tax credits, DOE’s home energy rebates, LPO’s outstanding loan authority, and the green financing institutions supported by the Greenhouse Gas Reduction Fund (GGRF) grants.

- Tax Credits. For many tax credits, uptake is underway and surpassing expectations. According to updates from the IRS in June, consumers have received $1 billion in Clean Vehicle Tax Credits (30D), which provides a $7,500 credit to consumers who purchase an EV assembled in North America. Furthermore, with Direct Pay rules finalized as of this March, non-tax paying entities like School Districts and Local Governments are able to take advantage of clean energy tax credits to support purchases of electric school buses and rooftop solar installations.

- Rebates. DOE funded Home Energy Rebates are available in two states: New York and Wisconsin. California, Washington, Arizona, New Mexico, Indiana, Maine, Hawaii, and Rhode Island are slated to be next, as they’ve had their applications approved by the DOE. 13 states and D.C. have submitted applications, and the rest of the states are preparing their applications.

- Loans. The DOE’s Loan Programs Office (LPO) has billions in remaining authority to support clean energy projects.

- Green finance. Other financing options being supported by the GGRF funds, which are making their way through the country’s green finance infrastructure. These programs are expected to stand up by fall 2024, when they will begin to support projects.

Implementation efforts in year three and beyond hinge on November’s Election

Given the pace of IRA implementation over the course of 2024, it is likely as much as two-thirds of the law’s funds will be obligated by January 2025. Still, the IRA has been targeted for repeal. There are a range of ways that a change of administration could impact the law and its many programs, and some funding is more at risk than others. First, the clean energy tax credits, estimated to amount to over $500 billion in incentives, are implemented by the Treasury Department, which means implementation rules could be rewritten. Only two vehicle tax credits are finalized, with 20 more not yet finalized. However, repealing the tax credits entirely would require Congressional action. Second, though much of IRA’s funds are or are soon to be obligated, some funding will not be available to award until the start of 2025’s fiscal year, which begins a month before the national election. Federal agencies could slow or pause the distribution of the remaining grant funding. However, the funding that is in the “pipeline” to recipients is likely safe from interference, according to former administration officials and experts. Furthermore, any attempts to “take back” formally awarded funding would be both legally and politically challenging.