August 16th, 2023 was the first anniversary of the passage of the Inflation Reduction Act (IRA). While the IRA was not solely passed as a climate or energy bill (it includes provisions on the US national debt and medical care, among other things), it is the largest investment ever in clean energy and climate. The Congressional Budget Office (CBO) originally estimated the cost of the climate provisions at $392 billion ($121 billion in direct spending and $271 billion in tax credits). However since then others have estimated the total cost of the package to be higher. Goldman Sachs estimated the total cost to be $1.2 trillion, Credit Suisse estimated the cost to be $800 billion and the Brookings Institution estimated it would cost $1 trillion. This variation comes from differing assumptions on the uptake of tax credits over time. What holds across these more recent estimates, however, is that the climate tax credits appear to be more popular than anticipated and therefore may increase the climate impacts of the law.

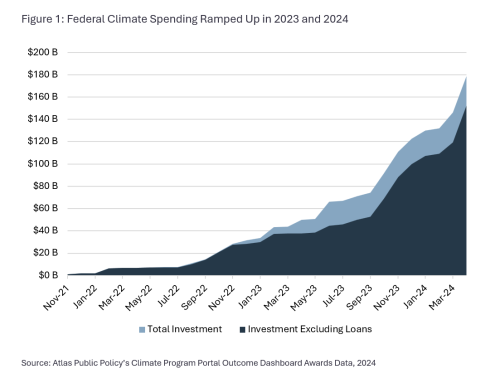

Funding for programs, states, and departments (as opposed to tax credits) will be released over time. The Climate Program Portal uses several designations to indicate the status of the funding: allocated, available, and awarded.

Funding Awarded

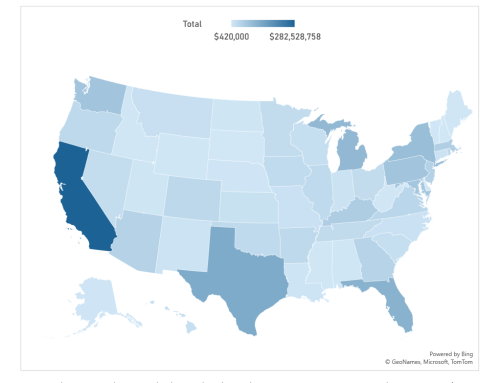

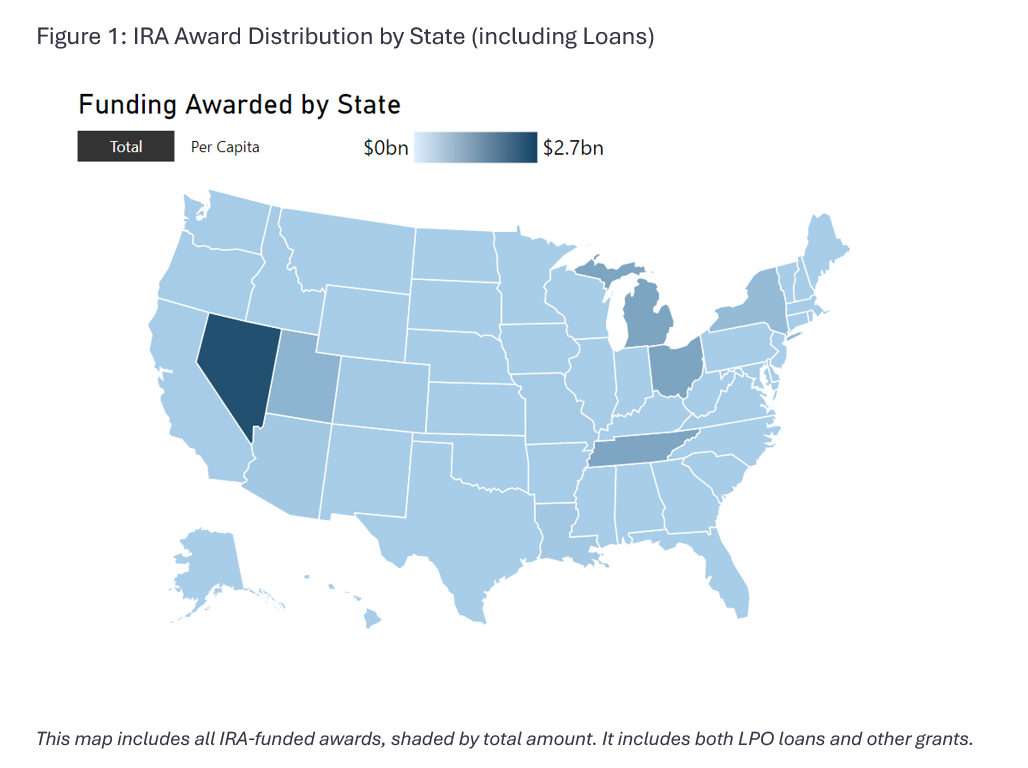

Only approximately $10 billion of the total funding has been awarded for specific projects, and another $10 billion officially allocated but not yet awarded. Of the funding released, almost all has gone to the Department of Energy’s Loan Programs Office (LPO). The LPO has announced several loans, including a conditional commitment for a loan, to several types of energy projects. Most prominent is the development and manufacturing of batteries for electric vehicles. A conditional commitment indicates that the business and the LPO have agreed on terms, and when they are met the project will receive the loan money. For example, In February 2023, the LPO granted a conditional commitment for a $2 billion loan to Redwood Materials for the development of a battery and materials manufacturing facility in Nevada. The conditions of this loan include the number of jobs, as well as requiring that the focus is on hiring union members, workers of color and women. As of August 28th, there has been no announcement on the final loan. There are two reasons that the LPO has dispersed funding before many other programs – first, it is an established office with an existing budget and second, that the LPO has a different application process from many other government funding programs. Projects do not have to go through the request for information (RFI) and request for proposal (RFP) processes, which may speed up the allocation of funding.

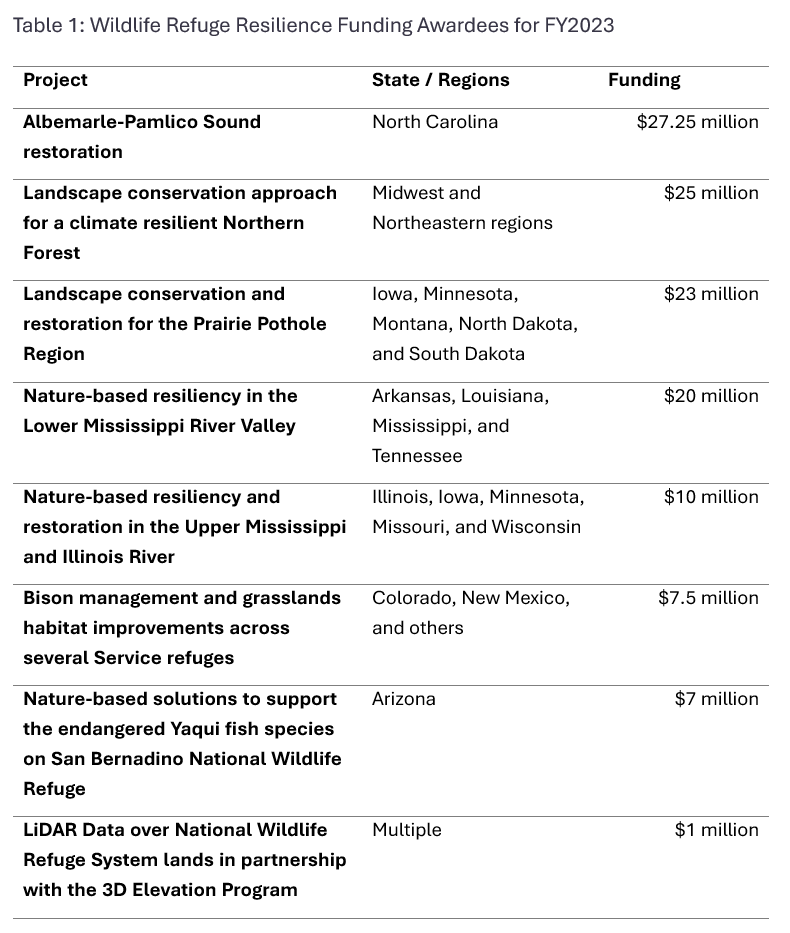

The non-LPO awards have gone to three programs and funding for the General Services Administration (GSA). First, there is $120 million for shoring up resiliency in national wildlife refuges, announced March 7, 2023. The national wildlife refuge resiliency funding is part of the wider Restoration and Resilience Framework developed by the Biden Administration aimed at improving conservation efforts. The funding will go to projects and wildlife refuges across the nation, with a concentration in the midwestern states. The project awards are summarized in Table 1.

Next, there is the $188 million for the Forest Legacy program including $100 million from the IRA. The funding is designed to ensure “that the most important forested landscapes continue to provide economic and social benefits to the communities that depend on them for their lives and livelihoods.” The funding will go toward conserving 245,000 acres of working forest land in 22 states, through 34 individual projects.

Third, the Environmental Protection Agency (EPA) has awarded nearly $250 million in planning grants as the first phase of the Climate Pollution Reduction Grants program, discussed further below.

Finally, the General Services Administration (GSA), which is the landlord for all federally-owned buildings in the United States, has begun distributing funding from both IRA and the Infrastructure Investment and Jobs Act to upgrade federal buildings. This effort is part of the Climate Smart Buildings Initiative, designed to cut federal building emissions. The total available IRA funding for this initiative is $3.4 billion including:

- $2.15 billion for low-embodied carbon materials for construction projects;

- $975 million for emerging and sustainable technologies; and

- $250 million for the Assisting Federal Facilities with Energy Conservation Technologies (AFFECT) program to convert federal facilities into High Performance Green Buildings.

The first round of awards was announced in December 2022, totaling $300 million, and further funding has been announced since. The largest of these was a $975 million award announced in June 2023 which focuses on electrifying buildings across the country. This funding will electrify 100 government owned buildings including a $13.5 million grant to electrify the Ronald Reagan Building and International Trade Center in Washington DC. However, most of the other announcements do not specify which buildings they will be funding or what proportion of cost is from the IRA.

Funding Announced

Other funding programs are in motion. Looking particularly at RFPs via the Opportunities Dashboard, there are 24 open RFPs, 17 closed RFPs, and 71 closed RFIs, indicating that the process is moving forward. These RFPs included three large programs that are worth unpacking: the Greenhouse Gas Reduction Fund (GGRF), the Climate Pollution Reduction Grants (CPRG), and the Green and Resilient Retrofit Program (GRRP).

Greenhouse Gas Reduction Fund (GGRF)

At $27 billion, the GGRF is the largest single IRA climate program, excluding tax credits. At the end of July 2023, an NOI closed for a $7 billion residential solar grant competition (“Solar for All”) that will be distributed as 60 awards. Additionally, the Environmental Protection Agency (EPA) has earmarked $14 billion for a National Clean Investment fund, which will create a handful of clean financing institutions able to interact with the private sector. The remaining $6 billion will go to the Clean Communities Investment Accelerator grant competition, which “will be awarded to two to seven intermediary nonprofits that will use funds to build the capacity of pubic, quasi-public, and non-profit community lenders in the green financing community.” Just last week, the EPA announced the states, NGOs and municipalities that submitted a Notice of Intent to apply for Solar for All funding. No state agency/entity from Florida, Nevada, Idaho, Montana, North and South Dakota submitted a NOI, though municipalities and NGOs applied for funding from those states. For more information on the specifics of the GGRF, see Atlas’s Issue Brief from April 2023.

Climate Pollution Reduction Grants (CPRG)

The CPRG is a $5 billion dollar program that will provide grants for states, local governments, and tribes to reduce greenhouse gas emissions using local strategies. As of now, the program is rolling out the last of its initial $250 million worth of planning grants to states, cities, and tribes. The planning grants are set at $3 million for states (plus Washington DC and Puerto Rico), $1 million for eligible cities, $25 million total set aside for tribes, and $500,000 for other territories. The remaining $4.6 billion after the planning grants will be rolled out in the form of competitive grants (with funding tiers for similarly-sized projects), with a notice of funding opportunity (NOFO) set to be released later in 2023. Notably, four states – Iowa, Florida, Kentucky and South Dakota – did not meet the deadline to submit their intention to participate, excluding them from receiving both the planning grants and the later awards.

Green and Resilient Retrofit Program (GRRP)

The GRRP, run by the Department of Housing and Urban Development (HUD), received approximately $2 billion from IRA to help decarbonize HUD-assisted multifamily housing, divided into three funding “cohorts” by HUD. The GRRP currently has three RFPs that will remain open until early 2024, one per cohort. HUD has allocated approximately $140 million in funding to award winners for the first cohort, “Elements.” This funding will go to projects that install clean energy elements such as the installation of electric HVAC heat pumps, Energy Star windows, fire resistant roofs and clean energy generation systems. HUD anticipates making approximately 200 awards for this category. The “Leading Edge” cohort will have approximately $400 million in funding for 100 awardees, while the “Comprehensive” category will have $1.47 billion for 300 awardees.

Other Announced Programs

Agencies continue to advance other programs. Several programs recently announced available funding, including:

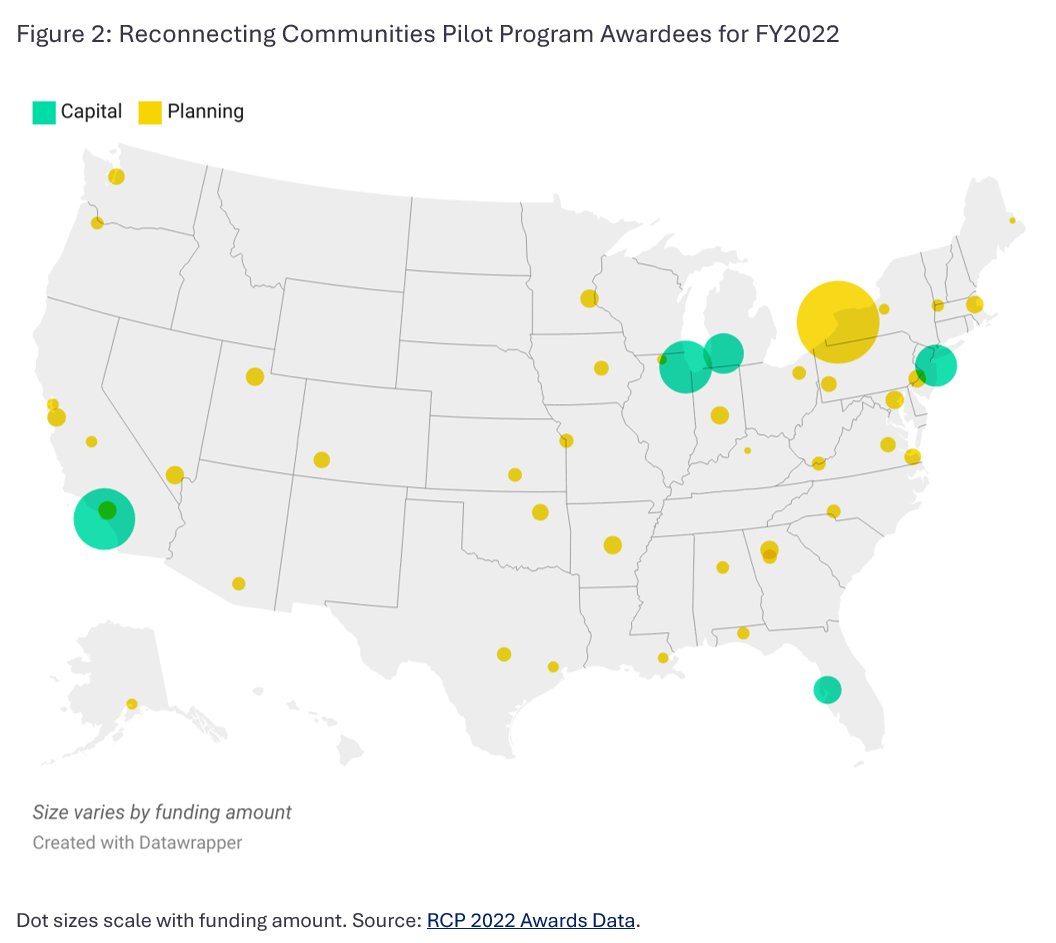

- The Department of Transportation recently announced a NOFO of nearly $200 million for the Reconnecting Communities and Neighborhoods program, which assists in connecting communities via public transit and urban design. This program combines funding from both IRA and the Infrastructure Investment and Jobs Act (IIJA). Earlier this year, the Department awarded $185 million to 45 communities as part of the Reconnecting Communities Program, including five Capital Construction grants and 39 Community Planning grants (see Figure 2).

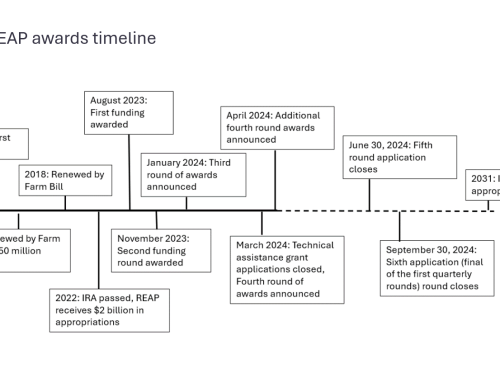

- The Department of Agriculture (USDA) announced $1 billion in March 2023 for the Rural Energy for America Program (REAP), which helps farmers invest in efficiency and renewable energy. This funding is to be distributed over six quarters throughout this year and next through grant competitions. REAP pre-dated the IRA, but the funding has bolstered the program and increased the government share of the grant.

- The Department of the Interior announced $145.5 million for the Tribal Electrification Program to enable tribal household clean electrification. Pre-applications will close on September 18, 2023.

- The IRA also required the Biden Administration to lease federal waters in the Gulf of Mexico for oil and gas drilling. The newly lease-able area is divided into Lease Sales 259 and 261. Congress required Lease Sale 259 be held by March 31 of this year and Sale 261 by September 30th, 2023. Accordingly, Sale Area 259 has now been divided and sold, with 299 of 313 tracts leased for a total of $250,556,978, with 32 companies participating in the auction. The remaining 14 tracts will be available in future sales, and the Sale for 261 will take place on September 27th, 2023. Lease Sale 258 in Alaska also went ahead in December 2022.

These programs will likely announce awards over the coming months. In May of this year, my colleagues Tom Taylor and Jaclyn Lea published a report reviewing the past year of climate policy supported by IRA and IIJA, which includes more information on many of these programs.

What comes next?

A year after its passage, the rollout of IRA funding is picking up pace. The next year will see many announcements of project funding, as well as awards to other departments, states, and municipalities, which will increase the general impact of the law. It has already spurred billions in private investment, and continued expansion of clean energy projects will only further foster a dynamic public-private relationship. Additionally, consumers and companies who have taken advantage of tax credits from the IRA will begin to feel the financial benefits. Even a year after its passage, the true scale and impact of the Inflation Reduction Act is only just beginning to show.