Overview

Come October, it is time for a Q and A on the two big Acts. We asked you for some of your burning questions about the implementation of IIJA and IRA. Thank you to those who sent through questions. We have conferred with experts at the Department of Energy and scoured available resources to bring you the latest. Still, many specifics remain unknown, and we expect more clarity to come with future program guidance.

We also know that there is a wealth of knowledge in this community. If you have insights on any of the questions below, we welcome your input. Please get in touch!

The Tax Credits

Let’s start with the big picture and zoom in. We are tracking 24 tax credits, all of which are in the Inflation Reduction Act. These tax credits are worth an estimated $265 billion.

Eligibility, as you know, depends on the tax credit. We have built out a table below with some of the key tax credits. Eligible recipients are also listed on the Dashboard, but eligibility is often complicated.

If you’re interested in EV tax credits, this podcast episode from a few weeks ago is a crystal-clear breakdown of how the EV credits will work. For buildings, this explainer from RMI provides a great overview. For all others, the Bipartisan Policy Center has put together a comprehensive breakdown.

This largely appears to still be up in the air. We do know for certain that the Clean Hydrogen Production Tax Credit (45V) cannot stack with the Carbon Capture and Sequestration Tax Credit (45Q).

For the rest, from our contact at DOE, “DOE is working with Treasury and the Internal Revenue Service as they develop guidance which will determine how these provisions are implemented. For several provisions, there will be a forthcoming request for comments to gather stakeholder input and we recommend you point stakeholders to those documents.”

The Treasury currently seeks input through six distinct requests for comment.

First, let’s start with some definitions here so we are all on the same page.

- Refundability (Direct Pay): Direct pay allows entities or individuals that do not owe federal taxes to receive a direct payment instead of a credit against their taxes owed. Section 13801 of the Inflation Reduction Act makes some but not all of the clean energy tax credits eligible for direct pay. Further, several tax credits are only eligible for direct pay for tax exempt entities, for example public entities, nonprofits, or churches.

- Transferability: Section 13801 of the Inflation Reduction Act also includes a new provision that allows for entities to transfer certain tax credits to third parties in exchange for cash. This provision could help project developers with limited federal tax liability monetize their tax credits. Some provisions have special rules around transferability. For example, the clean vehicle tax credits only allow taxpayers to transfer the credit to the dealer who sold them the vehicle.

These new provisions are an important policy shift to make clean energy tax credits more equitable. For example, let’s take Gabriel. He has no tax burden and has just purchased a new electric vehicle. Previously he would not be able to access the Clean Vehicle Tax Credit. Now he may transfer that credit to the dealership in exchange for cash or a payment on the vehicle, effectively monetizing the tax credit.

The Request for Comment Issued by the IRS provides further insight on direct pay and transferability.

| Credit | Direct Pay | Transferability | Eligibility |

| Clean Electricity Production Credit (45Y) | Tax-exempt only | Yes | Any qualified facility

(ii) which is placed in service after December 31, 2024, (iii) and for which the greenhouse gas emissions rate is not greater than zero. |

| Increase in Energy Credit for Solar and Wind Facilities Placed in Service in Connection with Low-Income Communities (Part of 48 ITC) | Tax-exempt only | Yes | A facility shall be treated as part of a qualified low-income economic benefit project if at least 50 percent of the financial benefits of the electricity produced by such facility are provided to households with income of either:

(i) less than 200 percent of the poverty line, or (ii) less than 80 percent of area median gross income |

| Clean Electricity Investment Credit (48E) | Tax-exempt only | Yes | Any qualified facility

(i) which is used for the generation of electricity, (ii) which is placed in service after December 31, 2024, (iii) and for which the greenhouse gas emissions rate is not greater than zero. |

| Residential Clean Energy Credit (25D) | No | No | Individuals whose homes include the following target technologies: solar electric systems, solar hot water, fuel cells, small wind, and geothermal heat pumps. |

| Extension, Increase, and Modification of New Energy Efficient Home Credit (45L) | No | No | Single-family homes or manufactured homes that meet Energy Star requirements, or the Department of Energy Zero Energy Ready Home standard. Also, Multi-family homes that meet the Multifamily Energy Star requirements or the Zero Energy Ready Home standard. |

| Energy Efficient Commercial Buildings Deduction (179D) | No | No | Building owners. Tenants may be eligible if they make construction expenditures. If the system or building is installed on federal, state, or local government property, the 179D tax deduction may be taken by the person primarily responsible for the system’s design. |

Funding For Cities

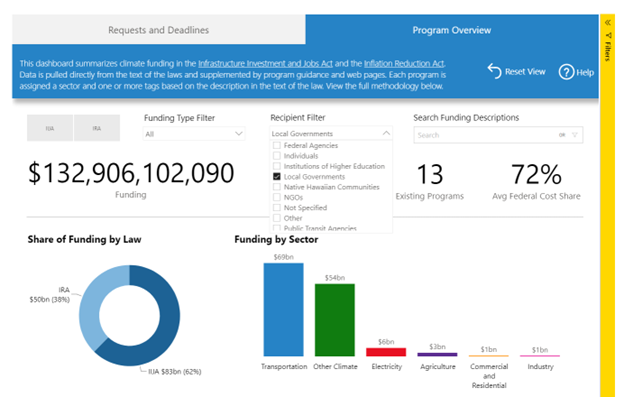

The first thing to note is that it is possible to filter by recipient on the Dashboard. See the image below. This may not solve the problem but can get you some of the way there.

Next, some of the most recent solar funding opportunities are here: Bipartisan Infrastructure Law Programs | Department of Energy. More specifically, we have seen the following:

- Funding Notice: Solar and Wind Grid Services and Reliability Demonstration | Department of Energy

- Pumped Storage Hydropower Wind and Solar Integration and System Reliability Initiative | Department of Energy

Here are some other programs that may be available to cities for solar projects:

- Greenhouse Gas Reduction Fund includes $7 billion for state, local, and tribal governments or nonprofits to deploy zero emission technologies.

- Environmental and Climate Justice Block Grants has $3 billion to implement community-led projects to remediate environmental risks to public health.

- Energy Efficiency and Conservation Block Grant Program has $550 million to assist local governments, states and territories, and Tribes implement strategies to reduce energy use.

- Clean Energy Demonstration Program on Current and Former Mine Land must fund at least two solar projects on former mine land.

- Renewable Energy Projects has funding for pilot geothermal, wind, and solar energy projects.

Justice 40

The full list of Justice40 covered programs is available, here. The measuring is tricky, as you know. Justice40 requires that “40 percent of the overall benefits flow to disadvantaged communities”, though how that is measured is the key question. The Office of Management and Budget (OMB) is meant to put out guidance here but we have not seen any. They put out some interim guidance in July 2021 here. In September 2022, more than 60 representatives wrote to OMB among other agencies to seek greater transparency and to push for 40 percent of investments to take place in disadvantaged communities (not just the benefits).

This was the response from our contact at the Department of Energy, “The US government is committed to Justice40. Each grant and program is a bit different and so stakeholders will need to refer to the guidance document for those programs.”

Portal Access

Any local government officials are eligible to join the Portal! If you have specific people in mind, get in touch!